#Turbotax advance stimulus free

(TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid. We will not represent you before the IRS or state tax authority or provide legal advice. Audit Support Guarantee – Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2022 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited individual returns filed with TurboTax for the current 2022 tax year and, for individual, non-business returns, for the past two tax years (2021, 2020).(TurboTax Online Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back – Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state purchase price paid.This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. 100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.If you're an online seller selling on platforms like Ebay, AirBnB, Etsy, and VRBO with more than 200 transactions that exceed an aggregate of $20,000, you should receive Form 1099-K.

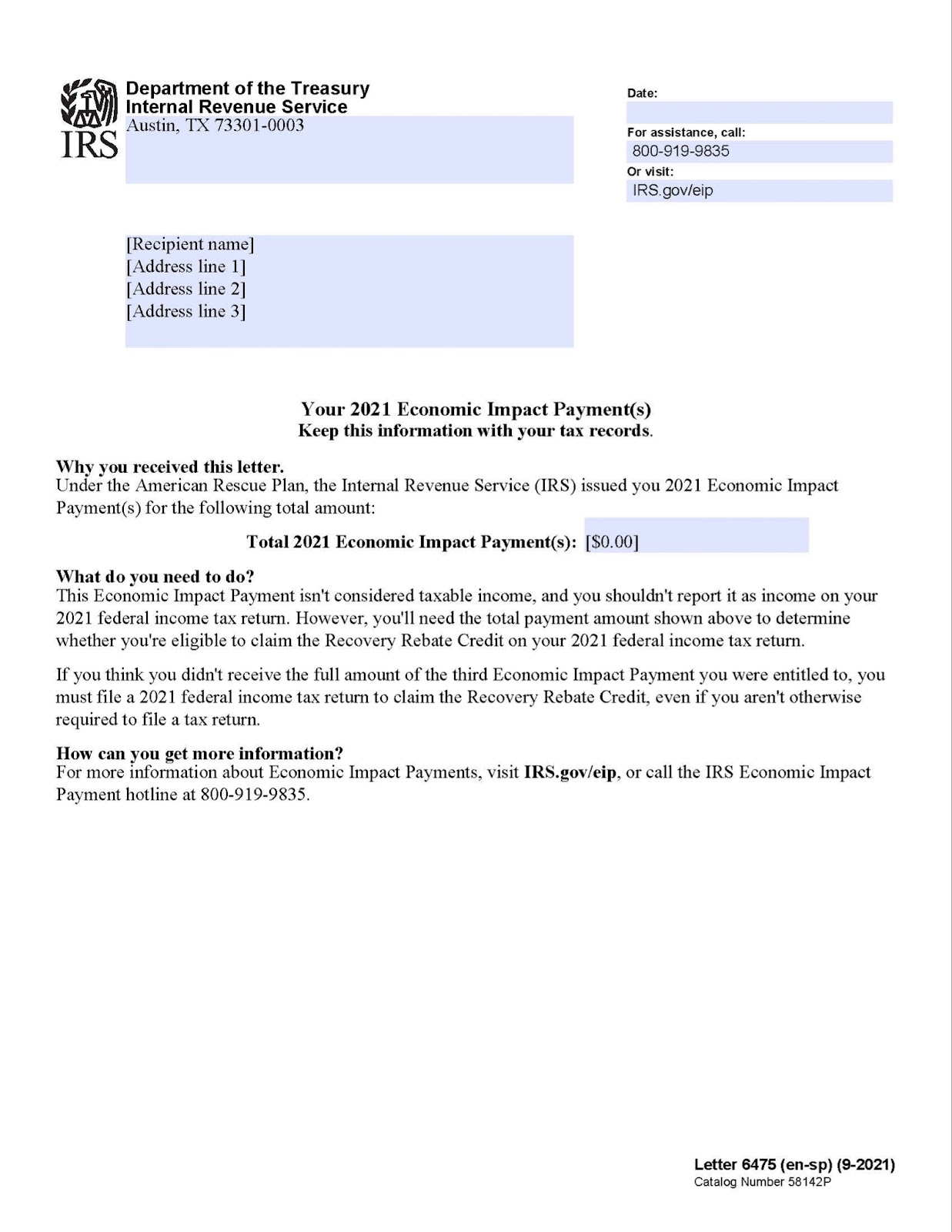

This includes creators, influencers, ride share drivers, or side-giggers. If you're self-employed and accept credit, debit, or prepaid cards, you may receive Form 1099-K for more than 200 transactions exceeding an aggregate of $20,000 processed by a third party.As a result of this delay, well known third-party settlement organizations (TPSOs) will not be required to report tax year 2022 transactions on a Form 1099-K to the IRS or the payee for the lower, more than $600 threshold amount enacted as part of the American Rescue Plan of 2021.

Form 1099-K (Payment Card and Third Party Network Transactions) is used by credit card companies and third party processors like PayPal and Venmo to report transactions processed for retailers and other third parties.

0 kommentar(er)

0 kommentar(er)